Aarti Singh is Senior Manager HR in HCL Info Systems. When she started earning she was clueless about finances. She was ignorant. She just followed the crowd or an agent’s advice. She invested in a few Unit Linked Insurance Plans (ULIP) of ICICI Prudential. Aarti is not the only one, I meet a lot of working women who are in a similar bind. Ill informed and ill equipped, they falter.

She has been investing since 2005. She is paying an annual premium of Rs 50,000 and gets a cover of Rs5 Lakhs. Her plan is a highest NAV in last 7 years linked plan. So far so good. But does she know how the NAV would be calculated? When I spoke to her, she did not even know what was a ULIP.

What is a ULIP? It is a unit of mutual fund with an insurance component. In ULIPs, a part of the premium goes towards providing you life insurance cover and the remaining portion is invested in mutual fund(s) which in turn invest the corpus in stocks or bonds. The value of your ULIP unit alters with the performance of the underlying fund opted by you.

In other words, ULIPS are bundled products. The insurance company tries to give you a carrot of insurance plus equity. The bait is that you will get higher returns than normal insurance. It is like going to Mc Donalds and taking a happy meal. A burger, fries , coke and toy. The happy meal is always costlier. The burger and coke combo if just taken separately is much cheaper, but the toy attracts the kids and we pay double the price for the happy meal !

My advice, please do not buy bundled financial products. Generally, they are financially sub optimal. Buy insurance for insurance sake. As explained in my last blog on life insurance, take a term cover and invest the balance in a good Mutual Fund separately. You will get a better bang for your buck. The MF will give you a better return than ULIP.

These days, Insurance companies come out with assured returns or assured NAVs. Wait till these schemes mature and see what you finally get. The companies have a lot of hidden costs which ignorant customers do not understand and therefore, do not ask about. They have a higher expense than the other insurance schemes. They also have a lot of conditions. An example of one such condition which I have lifted from ICICIPRULIFE goes like this , “The Guaranteed Maturity Benefit will depend on your age, gender, premium amount, policy term, Sum Assured multiple and the Reference Rates applicable at policy inception. Also this guarantee will not be applicable in case of policy surrender.” REMEMBER THAT IN A UNIT LINKED POLICY, THE INVESTMENT RISK IS GENERALLY BORNE BY THE INVESTOR. So if the stock markets tank, the NAV of your insurance unit also tanks and you get market related returns. Insurance company will never give you something from its own pocket. They are too smart for it and use the fine print for those conditions. If you have to bear the risk, then invest in MFs directly.

The allocated (invested) portions of the premiums after deducting for all the charges and premium for risk cover under all policies in a particular fund as chosen by the policy holders are pooled together to form a Unit fund. But your NAV at the start is already in negative due to a number of expenses. Some of the common expenses are:-

- Premium Allocation Charge

- Mortality Charges

- Fund Management Fees

- Policy/ Administration Charges

- Surrender Charges

- Fund Switching Charge

- Service Tax Deductions

As a result, if I buy a unit for Rs 10/- out of that Rs 3(less expenses) may go for insurance and balance Rs 7(less expenses) for equity investment. On both your Rs 3 and Rs 7, there are separate expenses which reduce the final amount which is invested. The total monetary value of the units allocated is invariably less than the amount of premium paid because the charges are first deducted from the premium collected and the remaining amount is used for allocating units. One must verify the approved sales brochure for the following issues:-

- All the charges deductible under the policy

- Payment on premature surrender

- Features and benefits

- Limitations and exclusions

- Lapsation and its consequences

- Illustration projecting benefits payable in two scenarios of 6% and 10% returns as prescribed by the life insurance council.

Some policies come with an assurance of highest NAV in first seven years. If you invested in a bearish phase of the market, you had it. Even otherwise, the NAV can be manipulated to be kept at a particular level by a smart fund manager. The AMC can show higher expenses and keep my NAV down or can sell the better investments in the portfolio and keep NAV depressed.

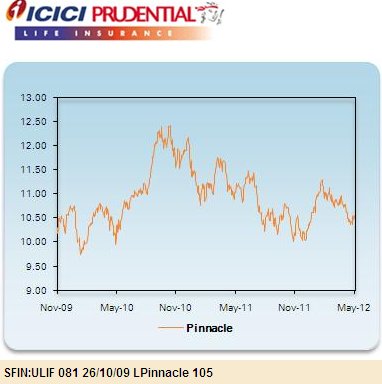

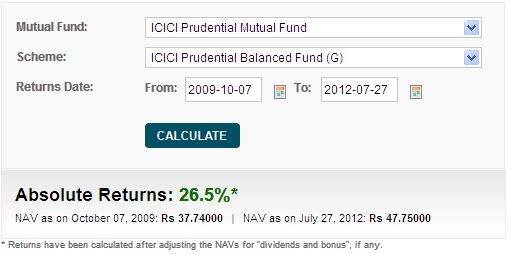

I took an example of an ICICI-Prudential ULIP Life Insurance scheme, ICICI Prulife Pinnacle. The period I have considered for my analysis is from the launch of this ULIP scheme in Oct 2009 to date.

From Oct 2009 till 27 July 2012 the NAV of Rs 10 has only become Rs 10.81 ie a gain of 8.1% in three years or a piffling CAGR of 2.79%. The same money in a MF from ICICI stable itself eg in ICICI Prudential Balanced Fund(Growth) would have risen from Rs 37.75 to Rs 47.75 an absolute gain of 26.5%.

I think some of my readers are taking the blog advice sincerely. In the past few weeks I got calls from at least three defence people on life insurance and endowment plans. I advised them and amended their plan. At the end of the day, they ended up with higher sum assured and if they were to survive, a couple of lakhs more in the bank, then what their agent was selling.

So take your pick and ensure yourself optimally.

Tailpiece: Aarti has ever since bought a term cover for a sum assured of Rs 40 Lakhs for age upto 60 years by paying an annual premium of Rs 4600 and she is putting the balance 45,400 saved from all her policies into Quantum Mutual Fund’s Quantum Long Term Equity (Growth Option) units through a monthly SIP.

Tremendous things here. I am very happy to see your post.

Thank you a lot and I’m taking a look forward to touch you.

Will you kindly drop me a mail?

Thx a lot