Mutual Funds are not only subject to market risks but also to taxes. So, if you pay your taxes, you better know the tax provisions too.

For an investor the options given by schemes are Dividend Option and Growth Option. In growth option only capital gains are involved at the time of redemption. However, in the dividend option, fund houses from time to time pay a dividend to the unit holder and those dividends are subject to taxes. A point to note is that the tax on the dividend distributed is paid by the MF but it effects your financial health, therefore, you must understand it.

As far as tax implications on Indian mutual funds are concerned, they are classified in three categories:-

- Equity oriented Funds. Under Equity Oriented Funds, the sub categories are Equity Diversified, Equity Sector, Hybrid – Equity Oriented (more than 65% equity) and Arbitrage Funds.

- Liquid and money market Funds. Liquid Funds and Liquid ETF fall under Liquid Funds

- Debt Funds other than Liquid Funds. Ultra Short Term Funds, Floating Rate Funds, Short Term Income, Dynamic Income, Income Funds, Gilt Funds, Fund of Funds, Hybrid – Debt Oriented (less than 65% equity), MIP, FMPs fall under ‘Debt Funds other than Liquid Funds.

Tax Implications from FY13-14

In the FY14 Budget, the Finance Minister has proposed to increase the Dividend Distribution Tax (DDT) on Debt Mutual Funds (other than liquid and money market funds on which the DDT was already 25%) from 12.5% to 25% (plus surcharge and cess) for individuals and HUFs. The hike is proposed to provide uniform taxation for all types of funds other than equity oriented mutual funds in the Mutual Fund Industry.

This amendment will take effect from 1st June, 2013.

Tax on distributed income. Given the tax provision on the distributed income, fund houses pay taxes on the dividend distributed to the investors. Fund houses deduct DDT from the Dividend. So the dividends are tax free in the hands of investors.

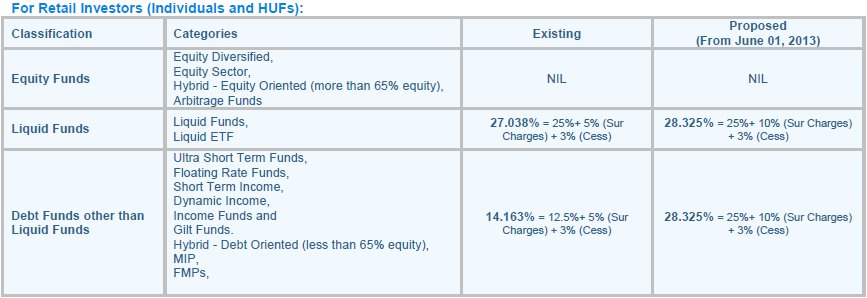

Existing tax structure on DDT. As per the existing structure, there is no tax levied on the dividend distributed by Equity oriented mutual fund schemes for any investors. But, Liquid and money market Funds are liable to pay the DDT of 25% (plus surcharge and cess) for retail investors while the funds other than Liquid and money market funds are liable to pay DDT of 12.5% (plus surcharge and cess).

Proposed Structure. From June 01, 2013 onwards, retail investors who invest in all debt funds (other than equity funds) are liable to pay DDT of 25% (plus surcharge and cess) on the dividend income. The DDT for corporate investors has been kept unchanged at 30% (plus surcharge and cess).

Increase in Surcharge. Further, the surcharge on Dividend Distribution Tax for all mutual fund schemes has gone up from 5% to 10%.

Impact. This move will make dividend options in Debt Mutual Funds unattractive for retail investors. Because the net post tax return in the hands of the investors from dividend plans would be lower as the DDT charged on the debt funds has been increased from 12.5% to 25% (plus surcharge and cess). Meanwhile, the Growth options in the Debt Mutual Funds will become attractive for retail investors who redeem the investments after a year, taking advantage of long term capital gains.

Capital Gain. DDT is applicable for Dividend plan options of MFs whereas Capital Gains tax is applicable to Growth plans. The gains from the debt mutual scheme (growth option) are taxed depending on the period the investments in the mutual funds are kept. If the debt mutual fund units are redeemed after a year, then the gains thereon are liable to Long Term Capital Gain tax while the proceeds from the investments which redeemed before one year are taxed as Short Term Capital Gain.

For long term capital gains in mutual funds, the investor has to pay the tax @ 10% without indexation or 20% with indexation; (plus education cess) whichever is lesser of the two. Short Term Capital Gain is taxed as per the normal slab of the investors.

The table below gives the DDT implications from Jun 2013:

Summary

Remember dividend is not taxed in the hands of the fundholder, but then the NAV will come down that much. For example if I hold a fund with an NAV of Rs. 11, and it decides to pay out Rs. 1 per unit as dividend, it will pay a DDT of Rs. 0.285 and the NAV will fall down to Rs. 9.715 Effectively, that tax is paid by you. Thus, an increase in DDT reduces the NAV of your units in case a MF pays a dividend to you. Whereas, in a growth option there is no dividend outflow so no tax to be paid on that and the entire gain accrues to the NAV of the unit. At the time of redemption as a MF unit holder you only have to pay the appropriate Long term or Short Term Capital Gains Tax.

Growth option in Mutual Funds looks therefore, more attractive if the units are redeemed after a year. Gains thereon are liable to be taxed as Long Term Capital Gains @ lesser of 10% without indexation or 20% with indexation; (plus education cess) or short term gains if sold within a year (at your highest normal rate of tax ie 30.9%)

Thanks