Last week, we lost a doyen of Indian Value Investing Community. Though, what is investing if not value investing. All investing is willy nilly value investing but 90% of us act like gamblers and traders, therefore the word value-investing has got added to the lexicon of finance.

I never met Mr Parikh, I only followed his actions from afar. He was an honest man with integrity who wanted to benefit the middle class investors. He wanted them to create wealth in the long term. And he followed the KISS–Keep It Simple, Stupid– principle. Those of you who have not read the prospectus of PPFAS LT Value Fund, must read it to understand the ethical part of the fund he launched. He wanted investors with an outlook of minimum, 5 years. He did not want investors to be confused and launched only one scheme with an omnibus capability to invest in Indian and foreign equities. And he introduced a graded exit fees to encourage only long term investors. Aaj ki duniya mein, Who does it?

I read his first book in 2005, it was a great book but it took me 6 years to jettison my bad habits and follow the concepts of behaviour, emotions and their role in our financial health, as propounded by Mr Parikh.

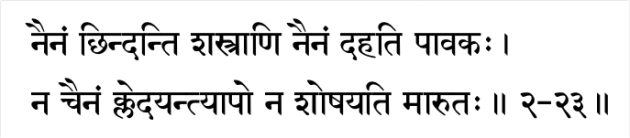

I have received a lot of queries from investors on, what after Mr Parikh? Should they withdraw funds? Should they stop their SIPs? The answer to all of them in one word is an emphatic NO. The Bhagvadgita (Chapter Two verse 23) says, about our soul and aatman,

Sri Krishna said: The soul can never be cut to pieces by any weapon, nor burned by fire, nor moistened by water, nor withered by the wind.

Paraphrasing it, I can say PPAS LT Value fund should not be cut, burned, moistened or withered from your portfolio due to Parag’s death.

There is a proper mechanism in place. There is a CIO or fund manager, there are analysts, there is a staff and there are successors. It may face a little turbulence temporarily but knowing Mr Parikh’s work ethos, he would have thought of such random mishaps and catered for them. So, my advice– DO NOT SELL, STOP, REDEEM or REDUCE YOUR SIPs or FUNDS into PPFAS LT VALUE FUND. Please continue investing.Do not worry.

The fund has invested into good businesses, with Mr Parikh’s passing away, those businesses are not affected, their profitability is not affected, so why should you be emotional about it. Remember, Motion se hi Emotion hota hai…..I stole the tag line of the just released Hindi film PIKU. Please do not move your funds and be emotional about it. Be a sanyasi, detach yourself from this incident.

The only truth and fact which is 100% predictable about us is that if we have been born, we shall also die. If death is the eternal truth, why worry?

PS: As a mark of respect to Mr Parikh, the day I read the news in the paper, I made a lumpsum additional investment into PPFAS LT Value fund of Rs 11000/- That was my way of showing solidarity and respect to Mr Parag Parikh. You choose yours.

Hi,

I am investing monthly into this fund. Do you still feel the fund is good for long term investment, please advice?

Regd’s

Tridip K Sarma

Tridip, I can only say that it is an honest fund so far. It is not churning its portfolio every month, it has minimal expenses and its investments are “hat ke”. If you have the patience of 5-10 years then invest in MFs/equities or else stick to fixed income. I still feel this fund is very good for long term investors. It is not advertise, rated or marketed, but that is a good thing. The moment a fund becomes too big(Assets Under Management or AUM increase), its returns start declining. Will HDFC Top 200 be able to give a 24% compounded return in the next 20 years, I doubt. I look at 18% compounded returns over a 20 yr cycle. 5 Lakhs will become 1 Cr in that period. ANd that’s good enough anything above is a bonus. I’d rather keep my money with someone I can trust. Hope it helps

Thanks for your article. Will do as advised by you. However, in hindsight, I think that I suffered from confirmation bias in this case.

Kuntal.

Nice one Kuntal 🙂

Dear Sir,

It was a shock and jolt to see the somber msg from PPFAS announcing the unfortunate incident. I, after coming to delhi, was very keen to meet him in person. Alas, that opportunity is lost forever.

As a mark of respect for the great humble Mr Parekh, I have bought a book of his & intend to read it.

As a wise man once said, “If I have been able to see far, its by standing on the shoulders of Giants”. For me, Mr Parekh was such a giant, with whom i have been in touch since 2012.

Adios Sir, May You find eternal peace.

Anshul Gaur