Are we heading for another crisis like the sub prime crisis? I think we are.

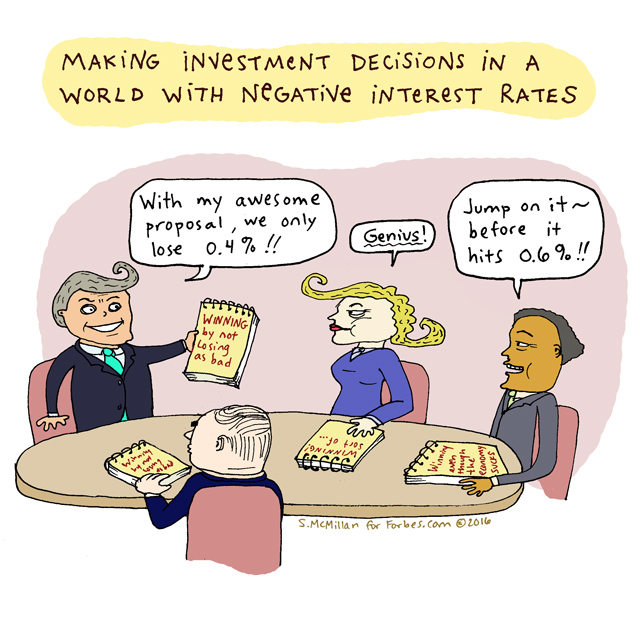

I am confused with the negative bond yields and interest rates in Europe and Japan. What is happening, man? I am just thinking of scenarios.

You are paying a borrower to keep your money. Yeah, you read it correctly. If you were staying in Denmark or Sweden and you had Euros 100,000 and you wanted to keep it in a bank, you would have to pay the bank some money. I have a friend Agneshwar, he is a government official who had a stint in Geneva. He earned in Swiss Francs and left his money in the bank in Switzerland itself. After an year, he was poorer by CHF 600. His bank had deducted 600 swiss francs i.e approximately Rs 60,000/- from his account for keeping his money.

Isn’t it illogical? Why should a person pay money to keep his savings? The idea of capitalism is that my capital is invested to give a return on my capital, thus increasing it and not erode my capital.

But that is what is exactly happening in Europe and Japan. The bond yields are negative. Interest rates are negative.

There is approximately $13 trillion money which is giving negative yields.

The question which one is bound to ask is how does it effect me as an investor in India? It does in a big way. This stupidity of central bankers in some countries will not sustain itself. Common citizens and investors in Europe will realize that if the government is unable to give a return on their capital, they may either consume it or else invest in other countries which are safe destinations and offer better returns. Gradually, the money will move out seeking better returns. Imagine approximately $13 Trillion moving out and seeking fresh investment vehicles/asset classes to ride upon. There will be a deluge of dollars at some point.

My take is that India is in a sweet spot. Some of this money will surely come to Indian shores and India will be flush with cheap money. This money will appreciate the rupee, get into real estate or into other business and infrastructure assets or into mergers and acquisitions or in the stock markets. And it will fuel another asset bubble somewhere in the world. When will it happen? Where will it happen? I will repeat Charlie Munger’s famous reply. I do not know.

But brace yourself, if even 10% of this money comes into India, you may have the mother of all bull runs in various asset classes. So, my dear investor, stay invested, gradually keep investing and do not keep waiting for prices to crash. They may not happen immediately. Eventually, markets will follow earnings and valuations, but the markets can stay irrational far longer than you and me can remain solvent.

Enjoy the Janamashtami holiday in India.