A lot of my friends and well wishers who have joined in as fresh readers and know me from earlier, when I was a teenager, have been pleasantly surprised with my foray into the financial world which is totally divergent from my regular job or routine. Psychology, History and Finance have been subjects which I was

fascinated with and in the past few years, I have added them to my mental tool kit.

As Charlie Munger, the Vice Chairman of Berkshire Hathway has come to the conclusion that in order to make better decisions in business and in life, you must find and understand the core principles from all disciplines. You should have a lattice of mental models on which you can hang your ideas. And for those models, you need multidisciplinary thinking and approach.

My endeavour for the past few years has been to increase the number of mental models in my head.

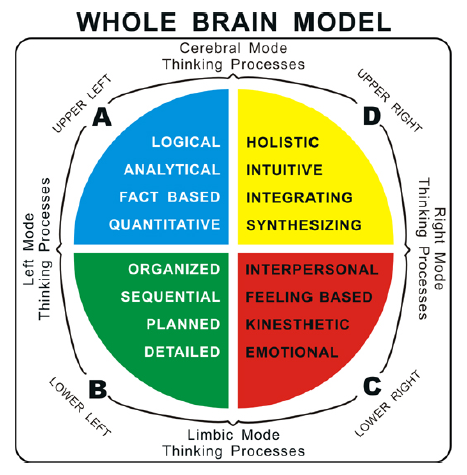

The increased upper right dominance of your brain (Hermann Model diagram) would lead to better decision making. And investments are all about decision making.

Earlier, I would panic when the markets would go down and invariably I would either sell my shares thinking I would again purchase them when the prices further fell or I would just sit out the carnage as suggested by the “Idiots” on the “Idiot Box” and watched by another set of “Idiots” like me. In the bargain, I would lose out on the upside, which would invariably come after a while.

Whereas now, I love it when the markets fall sharply. It is an opportunity to buy good businesses at cheaper prices. And because there was no one to guide me and encourage me to buy on such occasions, I make it a point to increase the frequency of my blogs when the stock markets are either too depressed or too excited. Because that is when you need guidance. The rest of the time, the markets just keep doing time pass.

So, what am I doing now?

I have invested whatever cash I was sitting on. I had kept some cash for my son’s college admission in June- July this year. Since, that is my need money, I have recouped it through a withdrawal from my Provident Fund. I do not keep any money in Fixed Deposits (because of tax free and higher returns on PPF/DSOPF than bank FDs), though I advise that at least 6 months need money should be in FDs for all non government salaried people.

I have additionally taken some money out from my PPF and that is being used for purchase of good businesses. In my PPF it will take 8.6 years to double my money. Whereas, from the current levels, good businesses may double in 4-6 years time. I still save 2 to 4.5 years, giving my money another cycle to double. So, be bold when others are timid, but also remember discretion is the better part of valour. Apply discretion to pick good businesses. Hasta La Vista!

” because there was no one to guide me and encourage me to buy on such occasions, I make it a point to increase the frequency of my blogs when the stock markets are either too depressed or too excited. ”

Sir, I may not be there to guide u, me being mostly lost myself, but will surely prod you to buy more or all east evaluate businesses more on these occasions.

Some friends say I am quite strong headed on this issue..

So , May I request you to evaluate for me ( please)

1. Larsen &Tourbo ( chief reason – avbl near 52 weeks low, but high debt)

2. IDFC BANK n IDFC ( seems cheap, but don’t really know how to evaluate banks)

3. Century Ply ( only recognised player in ply, boards & laminates mkt)

4. Pidilite Industries ( great brand – moat, but what should be entry levels)

5. United Spirits ( even at Rs 2750, its avbl at a eye-widening PE of 173 times, with high debt)

Hope u shall b able to give pointers for correct entry levels for me to further evaluate them on my own n take decision. All are with a time frame of more than 5 yes.

In the meanwhile, I will keep searching my pockets for any mullah that can be spared to enter the market. Probably will close some bank accounts n free up sm money..

Regards

Anshul Gaur

Will Analyse the businesses mentioned by you and get back.

L&T for 5 years is a good buy despite the debt as capital goods industry has to have debt on the balance sheet to grow and payment cycles force one to have debt. From a Rs 1000-1100 levels the stock can very easily give you a 50-100% return in 3-5years, horizon. Time frames can change but returns should be there.

IDFC Bank has a market cap of 15000 Cr and if you were to look at a 10 year time frame it could be a four to six bagger from here. It is not affected by bad debts so much being a new bank. Also. look at DCB Bank if you have a ten year horizon. Its market cap is just 2000 Cr. A worthwhile pick for the long term.

Plywood is a commodity. Where’s the moat in Century Ply?? Customers can switch to other options.

Pidilite is a great brand, product and business with a wide moat. With crude being low, its raw material prices are cheap. It is growing nicely. But at this price expensive. I would start buying sub 500 levels.

United Spirits is a consumption theme which will play out in next 10-15 years in India. The biggest brand owner of top brands in liquor. The balance sheet is f%^$#ed up due to Mr Mallya’s shenanigans. Diageo management is busy cleaning up the mess. It may take 3-4 years to clean and see the returns after that. Sub 2500 levels United Spirits can be bought.

DO NOT LOOK AT OWNING TOO MANY STOCKS/BUSINESSES. Less is more, sometimes.

Thanks for such a prompt reply.

Can you still give me a pointer as how to evaluate Banks??

Will only keep upto 10 businesses in the portfolio.

Regards

Banks evaluation is basically connected to the amount they have as deposits and equity. Remove the SLR and CRR which is locked up. The balance is available to be loaned to customers/corporates and earn an interest on it. The Net Interest Margin tells you the story to some extent. What we need to do is analyse the loan book of the bank and see from which source is the bank making max income?

HDFC Bank makes a large proportion of money from fee based income.It has no hassles of becoming an NPA. Also, the loan conditions from HDFC Bank are very stringent. Thus its NPAs are very less.

The key to evaluating a bank is first knowing the sources of income and their proportion in total income, secondly, how big is loan book, who are the biggest loan takers and their capacity to pay. And then how big is the brand, its reach and book value.