“Dad, how is the Nifty or the Sensex calculated? ” , Arjun, my younger son who is studying in Class XII and has taken Economics and Mathematics as his main subjects, asked me this question over dinner. I had some idea that it is based on market capitalisation of the top 50 listed companies on National Stock Exchange multiplied by a weightage factor but it was not specific.

I am sure some of you would harbour the same question. So this blog is dedicated to the Nifty watchers or Sensex fans, what with the jump in Sensex being back on front pages of newspapers.

Why is Nifty or an Index required? The index of a stock market reflects the overall market conditions and mood of the economy. It can be used for a variety of purposes such as bench marking of funds, launching of index funds and exchange traded funds (ETFs) and other structured products.

The Formula for Index Calculation Index or Nifty = Present Free Float Market Cap of the Day/(Base Market Cap x Base Index Value or 1000) The Nifty constitutes the top 50 listed companies on the NSE based on free float market capitalisation. It is calculated daily and the constituents i.e which 50 stocks will be part of it are calibrated every six months. The base period selected for NIFTY 50 index was the closing price on November 3, 1995, which marked the completion of one year of operations of NSE’s Capital Market Segment. The base value of the index was set at 1000 and a base capital of Rs.2.06 trillion. ( BTW a trillion has twelve zeroes after it.) Effective June 26, 2009, NIFTY 50 is computed using Free Float Market Capitalisation weighted method, wherein the level of index reflects the free float market capitalisation of all stocks in Index.

What is Market Capitalisation or Market Cap of a company? Market Cap = Number of total shares of a company x Price of share

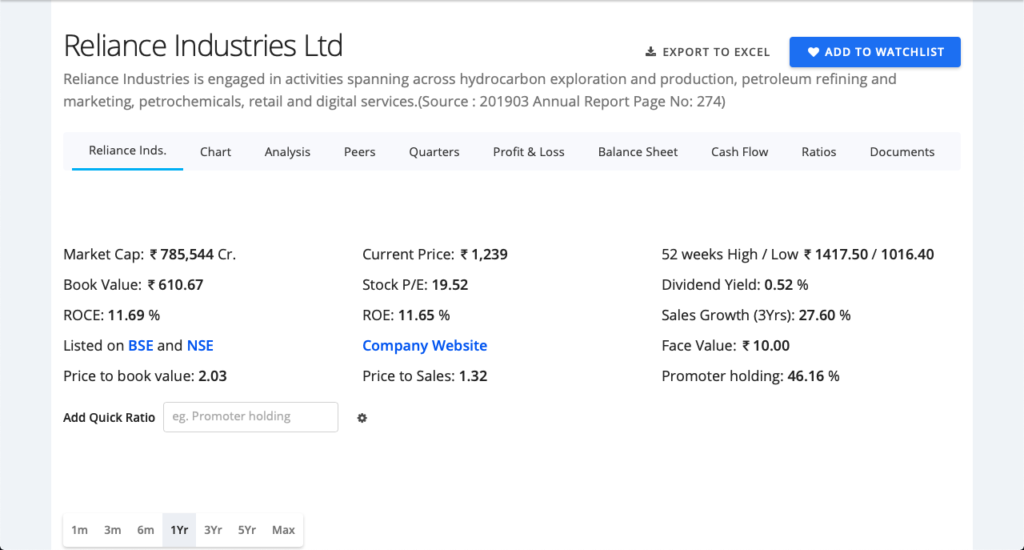

It is nothing but today’s closing share price of a company multiplied by the number of shares of the company eg Reliance Industries. Market Cap of Reliance= Number of Shares (634 Crores) x Closing Price( Rs 1239)= Rs 785,544 Crores

Market Cap of Reliance Industries on 23 Sep 2019

But the Nifty value is not calculated on Market Cap basis. It is now calculated on free float Market Cap.

What is Free Float Market Cap? Free Float Market Cap= Number of shares available for daily sale and purchase in the market (also called as Free Floating Shares)x Share Price

Free Floating shares distinguish between strategic or controlling shareholders and traders or buyers & sellers. Whereas, promoters are more interested in maintaining control over the business and long term economic fortunes, the buyers and sellers who are generally minority shareholders are more interested in the stock’s price and their evaluation of a company’s future prospects. They want an easy entry and exit from the stock. Free float of shares also denotes the liquidity of the stock, especially for financial institutions and mutual funds.

While calculating free-float market capitalization the following categories of shareholdings are generally excluded:

- Shares held by founders/promoters/directors/acquirers i.e controlling interest/bodies

- Shares held by the Government(s) as promoters/acquirers

- Holdings through the FDI route

- Strategic stakes by private corporate bodies/ individuals

- Equity held by associate/group companies (cross-holdings)

- Equity held by Employee Welfare Trusts

- Locked-in shares and shares which would not be sold in the open market in normal course

Reliance has a free float of 342.36 Cr shares versus a total of 634 Cr shares. It means approximately 291.64 Cr shares of Reliance are not traded and are held with the family of Mukesh Ambani or is controlled by him. Thus, Reliance has a free float market cap of Rs 424,188 Cr. And this figure is used to calculate the Nifty/Sensex.

Free-Float Investible Weight Factor (IWF)

This is a weightage decided by the stock exchange. IWF as the term suggests is a unit of floating stock expressed in terms of a number or a fraction available for trading and which is not held by the entities having strategic interest in a company. Higher IWF suggests that a greater number of shares are held by the investors under public category within the total shareholding pattern reported by each company. The IWFs for each company in the index are determined based on the public shareholding of the companies as disclosed in the shareholding pattern submitted to the stock exchanges on a quarterly basis.

Let us take an example for a company ABC Ltd.

| Total Shares | 1,00,00,000 | 100% |

| Held By | Number | |

| Shareholding of promoter and promoter group | 19,75,000 | 19.75% |

| Government holding in the capacity of strategic investor | 50,000 | 0.50% |

| Shares held by promoters through ADR/GDRs. | 2,50,000 | 2.50% |

| Equity held by associate/group companies (cross-holdings) | 12,575 | 0.13% |

| Employee Welfare Trusts | 1,45,987 | 1.46% |

| Shares under lock-in category | 14,78,500 | 14.79% |

IWF = [1,00,00,000 – (19,75,000 + 50,000 +2,50,000 +12,575 +1,45,987 +14,78,500)] / 1,00,00,000. = 0.61

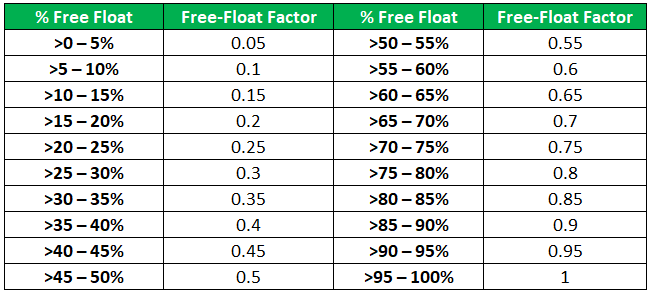

A thumb rule table for % of free float shares and FF factor is given below:-

What is the Implication of IWF? The higher the weightage factor, the greater it has the power to influence the sensex. ITC and Infosys with a Rs10 gain in a day can take the Nifty higher than a Reliance with a Rs10 gain can.

So, in lay man terms, the rise in Nifty from a base level of 1000 to more than 11000 i.e 11x in 24 years does not reflect the actual rise in prices of the stocks which constitute the Nifty. Some of those stocks in the last 24 years have multiplied by more than 250x. So a simple strategy emanating out of this blog would be to invest Rs 50000/- in each of the Nifty 50 stocks and Nifty Next 50 stocks. And leave it for the next 24 years. The 50 Lakhs you invest should by all conservative estimates turn into something upwards of Rs 10 Cr provided you have he time and patience to sit through those 24 years without doing anything.