In the past few days, since my last post, I have been pleasantly surprised. I am actually overwhelmed and surprised at the affection shown by all of you — a band of loyal readers. I have been made to believe that I may write sporadically, yet you look forward to it and read and make sense of the content. Your love has been a big morale booster. A Very Big Thank You.

A number of you have asked me to review my decision and keep writing even if it is off and on. So, I give unto your demands :-)…. In Hindi literature, there is a famous story , I read as a child Panch Parmeshwar of Munshi Premchand. And I guess it applies at this moment on me too. I therefore, accept Pancho Ki Rai and your opinion. And shall continue with the posts….. !!! And once again a big thank you and regards to all of you, especially Ajai Aggrawal and Anshul Gaur who were the first ones :-)).

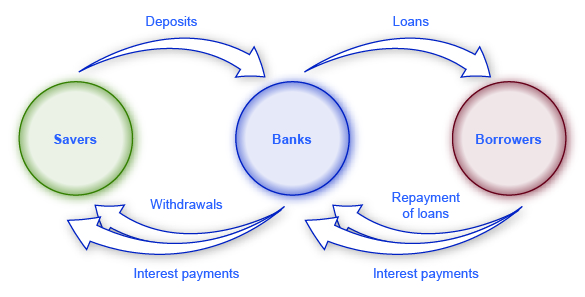

In my last blog I had suggested Bajaj Finance as one of the dozen picks, please replace it with Muthoot Finance (it is not in the Nifty). My reasons are simple. A Bank or Finance company has a very simple model. It takes money from depositors. And pays them a small interest. It then loans that money to others at a higher rate of interest. From the borrowers interest it first pays the depositors, then pays its expenses and keeps what is left as profits. So funda is very simple give depositors less, take more from borrowers and keep laughing to the bank…..literally. A bank laughing away to the bank. An oxymoron is it? 🙂

But the most critical link in this business is getting a continuous stream of interest from the borrower. That’s what we call an EMI these days. Thus, getting the interest and the borrowed amount back is the Most Important Part of this cycle.

Coming back to Bajaj Finance. Bajaj Finance though a fantastic company, has built its loan book around small loan seekers who want loans for personal consumption items like mobiles, laptops, computers etc. The crisis of Covid will in all likelihood take a toll on the receivables of Bajaj Finance. In simple words, the borrowers may default on the interest or simply move from one town to another address. Those EMIs will be a problem to seek and receive int he near term. So be cautious.

Whereas, Muthoot Finance’s business model suits my sensibilities more. It used to happen in our villages earlier, and still happens in a lot of villages. You need money. You go to a lender. The lender who was a village bania or a sahukar, gave you money. In return he took a collateral — your labour, or gold, or your land. And kept paying an interest. Muthoot is your modern day village Bania or Sahukar. Look at the simplicity of the model. You need money, please bring gold as a collateral. For Rs 100 worth of gold take Rs 70 as loan from me. If you do not repay, I keep the gold. ( I can sell it in the market for Rs 100 or even Rs 120 if the gold prices shoot up and you don’t pay.) My risk is limited to the price of gold on the day of default. In India, Gold=Emotions. People do not easily leave their ornaments with the lenders and repay the loan to get the gold back. So defaults are very few. And if you default, just too bad. I have the gold. For other lenders the risks are high. So, if I have to take a punt on an NBFC it will either be HDFC because of scale and past record in retail Housing Finance or Muthoot Finance.

Also, if you are still holding Piramal Enterprise , I will advise a sell . The reason is that Piramal borrows largely from banks and then lends. Now, the real estate market for next 3 to 4 years is likely to be in a limbo. And the big corporates to whom Piramal gave loans are seeking a moratorium on interest. The RBI has announced an extended Moratorium for the next 6 months. And interest payments by borrowers will be iffy. Piramal Enterprise has to generate upwards of 18% returns on its capital to just survive. Not an easy task in this situation. I am of the view that Piramal could see lower levels from present price of Rs 950/-. There is a huge amount of speculation taking place in the stock and Piramal Enterprise is selling a stake in its pharma business. Reliance is also selling stakes in Jio and main business and raising funds. Both Sambandhis — in North India we call them so, have their main businesses facing a threat of cash flows due to which they are selling their stakes. There is a storm brewing on the horizon. It may pass over or become an Amfaan. Only time will tell. Better be safe.

Reliance Industry like big Transnational Corporation (TNC) is a mini nation state today. It makes its own policies. And gets them promulgated through its influence. Nothing new. A lot of TNCs do that. Everyone in India knows that. Usually, the companies give an option of Renouncement of Rights in favour of another person by the shareholder in the offer letter/form. And if the offer is good, the share holder can take a premium directly from the person in whose favour the shares are renounced. But for the first time in the stock markets of India, the rights entitlement can be sold officially on the stock exchange. The Rights Entitlement is in the DP accounts of all shareholders. I sold them for my old friend Tej Pathak yesterday. If you are holding Reliance shares, sell the rights entitlement.

My reading is that the market will give you opportunities to buy after the Rights Offer of Reliance is closed. If it tanks, it will give an opportunity for you to buy your list. And will be another indication to me that Indian Markets are easily manipulated. A wise investor has to keep his ears to the ground. Keep reading…….

Sir,

1. Thanks a million for reviewing your decision.

2. Logical reasoning for Muthoot Finance is well understood and will be

implemented. I have stayed away from Reliance so far but surely look forward to it in

my portfolio.

3. Once again our sincere thanks for your valuable inputs and look forward to next post.

Regards

Vaishnav

Thanks OP

very kind of you. Reliance may have risen, but I hold my opinion on business having a manipulated price and foundation.We could make profits in other businesses too.

Sir, thanks for reconsidering my request. As usual, it is always interesting to read your musings, backed by logic and research.

Regards,

Ajay Agarwal

Thanks Ajay,

Very kind of you. Shall keep musing.

Hi Neeraj,

Good to see Fauzi back. i was late in reading your earlier post, noticed your frustration.

You wish your readers to be benefited out of your knowledge but system failed you. Dont worry, there are few like me who never invested but love reading your posts.

All the best.

manu

Thanks Manoj,

Very kind of you.