This blog is now 9 years old. Seems like yesterday. That’s the beauty of time. It passes off very quickly. We keep postponing decisions about doing a lot of activities in our lives. Don’t postpone. Just go ahead and do it. The rest of your life and ecosystem around it will adapt. Doing something now vs postponing is a decision. We take myriad decisions a day in our lives. Life is all about decisions and their outcomes. It is very simplistic when I write. But if you look back upon your own life, it is nothing but a sum total of big and small decisions or choices you made. Choices are also decisions. And their outcomes are largely like lotteries. Not known. Good outcomes may come from bad decisions and bad outcomes may come out of good decisions. If you play golf, you will understand better. A bad shot can still hit a tree and land on the green and a good shot may land in the pond. So outcomes are variable. The only constant part should be that your decision making is based on some process and is an honest effort. That’s what Lord Krishna also teaches Arjun in the battle of Mahabharata, where he exhorts Arjun to do his Karma or duty. “You have a right to perform and act (decision) on your prescribed duty, but you are not entitled to the fruits of those actions(Outcomes). Never consider yourself to be the reason of those fruits or outcomes, and also never be attached to not doing your duty (shun lethargy). – Bhagavad Gita, Chapter II, Verse 47 . Follow the right karma and process, 80% of the outcomes will in the long run , turn out well.

Therefore, if life is largely about decisions, then why do we take them in a jiffy, in split seconds? Because they are tiring. The brain has to use up energy, do some work and put in some effort in order to take decisions. Haven’t you seen our children leaving the Math problem and reading their favourite comic? The math problem eats up more energy and is more tiring when compared to reading a comic which is less of an effort. 99% of the decisions we take daily are mundane and routine in nature. How to go to office? Subway, Car, Bus, Bike? White Shirt or Beige? Davidoff or Tom Ford perfume? Black or Blue tie? These decisions are taken quickly by us because the outcomes have hardly any adverse consequences. The mind uses quick mental shortcuts called heuristics to do its duty. Also, we are not concerned about the fruits or outcomes of those decisions. Who cares about the shirt anyway? But if you take the remaining 1% important decisions also like this, then there will be a price to pay. Therefore, kindly take your time on important decisions of your life. Put pen to paper. Your investments are a part of those important decisions.

So, on this 9th anniversary, I thought that it may be a good exercise to analyze all my financial decisions of the last 9 years in my portfolio and would like you to do the same, whenever you have the time. The review involves stocks held for more than 1 year in the portfolio. It is an extremely important exercise to go over your decisions, if you wish to be a better decision taker. Otherwise there is no feedback loop for it. The only feedback you will get is post the event, which in financial decisions means you have been swindled or lost money or have been had by a Rana Kapoor and his Yes Bank AT1 Bonds.

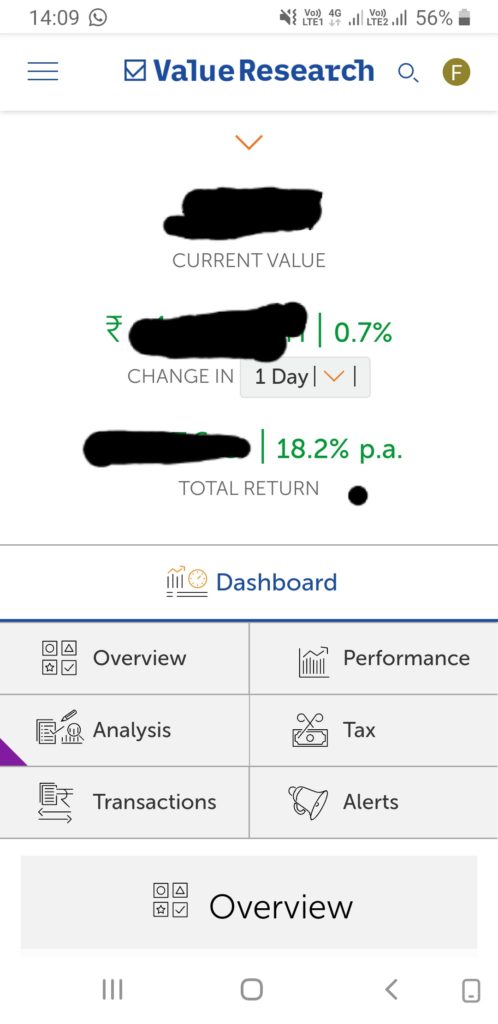

In 2012, when I started this blog, I had worked towards an objective of generating a compound interest of 18% or more on all my stock market investments for a long period of time. Why 18% ? Because the Nifty has given returns between 9% to 14% over ten year cycles(depending on what has been your investment period and what has been the time of your calculation). Therefore, for my active investing efforts I put a premium of 4%. I thought that I would analyze my portfolio over 9 to 10 year investment periods. And I had calculated that if I were able to achieve 18% and stay the course for 20 years, it will become a decent wealth creator. A million of Rupees (Rs 10 Lakhs) kept in this machine will become approximately 27 Million(Rs 2.76 Crores) or so in 20 years. A snapshot of returns and an analysis of my portfolio since Jan 2012 are given below.

If you want to track your returns, one of the better portfolio tracker is from Dhirendra Kumar’s Value Research It may not have a lot of other data but it is one of the few clean sites which gives returns on an annual compounded basis without racking your brains. It also has some very user friendly features. Even Marketsmojo gives the returns and is a good site. But I like Value Research more, a personal preference, I guess. I just hope it stays free of too many ads. All other trackers generally give you absolute returns which are misleading. I am not interested in knowing that my 1 Lakh has become 3 Lakhs. I am interested in the time it has taken to become 3 Lakhs. Because that gives me my actual compounded returns. In one of my investments I realised there was an absolute return of 296% but it was a CAGR of only 14.6%, which fell short of my hurdle rate. I have put my portfolio in this portfolio manager, and I do not look at it on a daily basis. I look at it once in three- four months, which is also too much. Ideally, I should look at it only once a year. That removes a lot of pain and variability from the process and makes us more rational investors.

The next step for me was to analyze the businesses which I had bought. Fortunately I had started writing a financial journal since 2012 so I had a reason for my every purchase decision and sell decision. (It would be a good idea to maintain a diary or journal by you also). One can then see the initial hypothesis playing out or not. Let us examine how I fared on my stupidities. I won’t gloat over my successes.

Two Major Losses:

1. Kitex Garments — CAGR (-) 39.4%. The financial statements were probably fudged or the subsidiary Kitex Childrenwear owned by promoters in the same line of work, in the same premises was being used as a proxy , something like Satyam, promoter’s intentions were not above board. I went wrong in trusting the promoter due to the media hype around what he was doing in Kerala. So the media stories about his good work, made me positively biased towards the business also. The red flags of money kept in cash in USA on the balance sheet, vs a 161 Cr loan in India should have desisted me from investing. So, I paid a price for ignoring some obvious red flags. I realised the mistake I had made and booked my losses and exited at Rs 100 in Feb of 2019, after holding the stock for 4 years. I had bought at Rs 650. Management also gave a 2:5 bonus as a placebo.

2. Wonderla Holidays — CAGR (-20.4%). The business became a victim of Covid-19 virus. The company had resorts and theme parks for holidays and vacations. The business got impaired . There was nothing wrong with the promoters, or the basic business but sales took a hit. The share price may still rebound quickly if the virus comes under control. But the sales and earnings may take a while to grow. I bought at 343 and exited at 189 after holding for 4 years.

Three Opportunity Cost Losses:

1. Thomas Cook CAGR (0%) . Again business was affected by Covid-19. The travel and tourism business got hit. I sold Thomas Cook shares at a loss, but the loss was made up by the shares of Quess Corp which were allotted free to all shareholders as part of a demerger and restructuring plan of Thomas Cook. So what I lost on Thomas Cook , I gained in Quess. Overall loss, was the interest on my money which I would have earned otherwise. Principal protected but gains zero. Bought at Rs176, sold at Rs50, allotted Quess worth Rs120.

2. United Spirits CAGR (0.2%). I made money on original purchase but lost money on the additional purchases made one year later. I paid the right price for the first purchase of United Spirits but over paid for the next lot of shares, ignoring the margin of safety on the second lot. So the gains of first lot cancelled out the losses on the second lot. I could have continued holding but I had another business available cheap so I switched. Time will tell whether it was a right or wrong decision.

3. Noida Toll Bridge CAGR (0.7%). In this investment, I preserved my capital, but I ignored the Screaming Risk of Indian Govt not following any rule or law but only listening to vote banks. So, I ignored the red flag of the Toll Contract being annulled by the Govt impairing a business. I was overconfident about the ethics of Indian Institutions and the sovereign. I was mistaken. Off hand, I remembered a talk delivered by the retired Cabinet Secy TSR Subramaninan, wherein he said, “India’s policy making is done by three groups — vote banks, rent seekers(commission agents, middlemen and crony capitalists who seek a rent on the public goods controlled by government and meant for use & welfare of the general public eg Telecom Spectrum, Oil Wells, Mining, Defence Purchases etc) and ideologues (Hindutva/Minorities/Cults etc). Noida Toll Bridge Company was sacrificed on the altar of Vote Banks. Bought at Rs 21, sold at Rs 13, dividends earned Rs 9 per share during holding period. The lesson I learnt was to stay 100 miles away from Indian Government owned businesses and businesses which could be impacted by them. So it’s a conscious call to have no rent seeker(s) related businesses like those owned by Ambani, Adani, Agarwals, Ruias, Mittals, Hindujas, etc ever in my portfolio. Btw, my father in law is a Reliance Bhakt. I am not. There are other businesses — HUL and Kotak Bank for instance — which have given similar or better returns than Reliance in the last 25 years.

Missed Multibagger: Vaibhav Global Having identified correctly, analysed correctly and having bought 200 shares at Rs 400, I lost nerve when it tanked to Rs 250. Rather than add more, I sold partially. And sold the balance when it rose to Rs 600. Exiting with a small profit of 8.1%. It went on to become a 20 bagger in 4 years. Not having the emotional discipline to practice what I preach, was the lesson. That is why every one is not a Buffet or a Munger. They have been like this for six decades.

Reading about behavioural finance and listening to podcasts and watching Youtube videos is totally different from actually having skin in the game and then acting upon the two major emotions of fear and greed with your own hard earned money. Sometimes a third party can take better decisions for your money.

Let’s dig deeper. Out of the stocks held for more than two years in my portfolio, one stock is generating a negative return of -0.2% , three stocks are giving 0 to 8% return, four of the stocks have generated between 10 to 17% returns and the balance twelve stocks are clocking above 18%. Bringing an overall return of 18.2% on the portfolio.

I am quite satisfied. I had set that as an objective, and I am on course. Could I have done better? Perhaps. If I had not sold some shares in Jun 2020. If I had not lost my capital on the two losses discussed above. If I had held on to Vaibhav Global shares. Then, my returns would have been close to 20.9% on a CAGR basis. But that’s like an oft repeated aphorism, If Auntie had balls she would have been Uncle. Have other people made higher returns than this? Sure. A lot of people would have. Or may have. I have no idea and no clue, about their methods. I am happy for all of those who have generated more returns than me on a 9 to 10 year basis. If someone is getting higher returns than me, it does not affect me. I remember my late mother’s advice, “If you chase money as a motive in life then remember, someone would be getting richer than you in every fourth house from yours. How many will you compete with? It is a never ending race. Avoid it. Set your own expectations from money and have enough to meet all your needs and some of your indulgences and then some dharam-karam or charity.

Some additional takeaways : Always keep 10-20% of your investible amount as a cash reserve to pounce on future market opportunities. They will come. Have patience. . With the balance stay invested through ups and downs for the long term.

Foregoing a 2% return for one to two years by keeping it in a bank on low interest may be a far wiser idea than buying over priced businesses. Because right now due to the low interest rates, every Tom Dick and Panwari is investing in stocks. So if all are rushing there, then you better don’t go there now. Take an elevator when it is going up empty, you won’t spoil your suit. Right now it is full while going up. Everybody is riding it. From a 20 year old student playing Zerodha to an executive who is working from home. All those who went to take the view upstairs have to return also. That is the day the returning elevator will be full and you take the elevator up because it would be empty.

And lastly, I have raised the bar for myself. I have decided on a new hurdle rate of 20% returns for the next 10 years ie till 2031. I may switch from a couple of existing businesses and replace them. Keep not more than 15-20 stocks in any one portfolio. Buy top notch high quality businesses which are selling at a discount or are out of flavour. Presently one of them is HCL Technologies. I bought some for friends and myself at Rs 902/- If you get to buy lower than that or around Rs915/- buy for next 4 to 5 years.

The next blog would be on some good mutual funds which a reader, Ajai Agrawal has requested. I want to do some research before dishing out advice.