I have not written for long as I have been sitting on the sides and watching the developments of the stock markets with amusement. But the dangerous levels of stock markets compel me to write now. On 23rd March 2020, India had 415 confirmed Covid cases and 10 deaths. The Prime Minister announced a lockdown and the stock markets tanked, hitting a multi year low at BSE Sensex level of 25981. The Nifty was at a PE level of 17.15. Worth a buy.

Today is 10 Aug 2020 and India has 2.2 Million cases of Covid-19 and 45000 deaths. The country has been partially/completely shut for 150 days, service industry is convulsing in the ICU — hotels, travel, eateries, movies, airlines, most are on hold. And surprisingly as Covid-19 cases are rising, the stock markets have also gone upi in these last few months. The BSE sensex closed the day at 38182. All pre covid levels regained. Everything is hunky dory on Dalal Street. Is it?

Inox the movie theatre chain’s revenue from operations slumped 99.94 per cent to Rs 0.25 crore during the first quarter of Jun 20. From Rs 493.01 crore in the corresponding period of the preceding fiscal. according to the company, the unprecedented circumstances resulted in “not even a single day of operations in Q1’FY21.” And the same is likely for Q2 also. PVR Ltd has not even published its quarterly results because it wants the Rights issue to collect money to sail through.

How long will Inox pay its staff? And if that staff has no salary, or reduced salary, will he buy his car? And if he postpones buying his car, will the tyre maker sell tyres? And if the tyre maker needs less rubber, the farmer in Kerala will also sell less or earn less and everyone in this chain will buy something or the other in lesser quantity. As a matter of fact under such circumstances, the Inox employee won’t probably buy even a dinner set, leave aside the car. So at some level even the kitchn appliance makers get affected. The writing, to me, is on the wall. Indian economy will take some time to recover. The Stock Markets are behaving less like a weighing machine and more like a voting machine. We fell down in a swoop and now we are buying stocks like there is no tomorrow.

All market indicators are saying run for the gates. There will be a stampede one of these days and you will not be able to leave the party. Remember Cindrella ! At the strike of 12 all princes will turn into toads. So better leave the party 15 mins earlier.

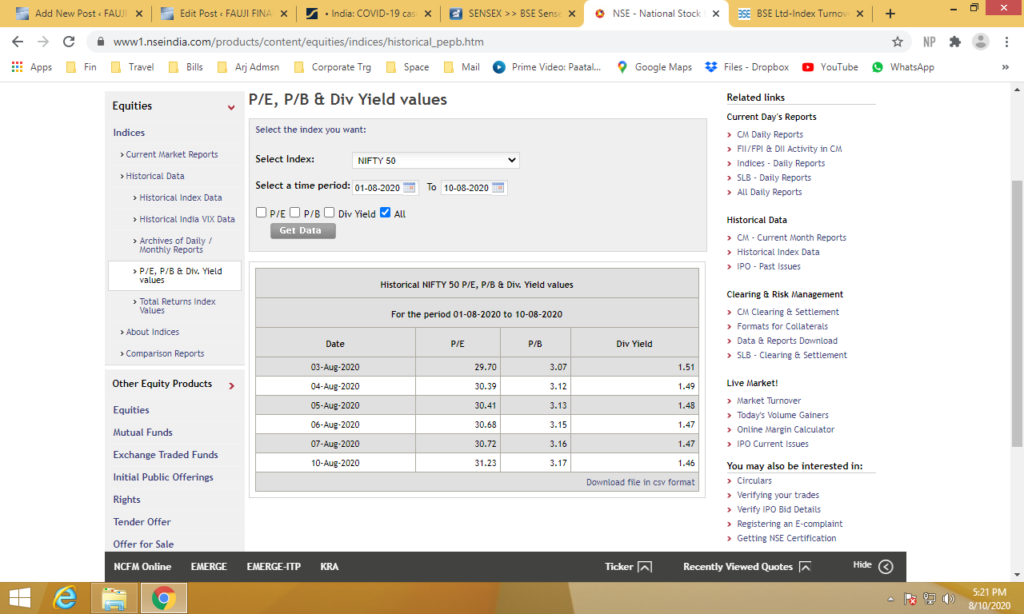

Look at the above screenshot of Nifty PE Level from the NSE website.

We are at a PE of 31.23. That is exorbitant by any standards. It is not supported by any earnings data. In the armed forces if an officer is to be rated “Outstanding” in his or her annual appraisal, it has to be backed by data and quantifiable achievements in the period of performance. Here there is zilch data to support the Nifty’s stratospheric level. Another metrics is the No of new demat and stock trading accounts opened in the last 5 months. It also says that when more accounts are opened, it is time to run. Stupid money is entering and smart money must exit.

If you are not selling, at least do not buy or buy very very selectively. I have been privately telling all friends and readers to not touch overpriced stocks since last few months. But if you had invested in March 2020 in some of my recommended stocks, you would have made 30-80% returns. Time to book profits and wait out. I for one have been steadily selling in select stocks. I will deploy that cash when the Index falls to 23rd March 2020 levels again. When will it happen? I do not know. Will the markets further rise next month? I do not know. They may. Won’t I be a fool to sell my holdings when the markets are doing so well? I am already looking like one. I started selling IPCA Labs from Rs 1300 incrementally at every Rs 100 rise. Didn’t I miss out on the Rs 800 gains IPCA closed last afternoon at 2100? Yes I did. Do I regret it? Yes a bit. I am human, not a robot driven by an algo. But who knows tomorrow the stock may start tanking and that regret may turn into happiness. As long as I have attained 18% returns on my portfolio, I am content. Whereever I have had outsized returns within a short span of time or have made big losses in the long run, I have sold those shares mainly due to the reason that if the markets were to go down south, everything will go with the tide. The losses will get compounded and gains get wiped out. I have personally pared 10-15% of my portfolio.

So, Adios Amigos…. only time will tell whether I was right or completely stupid. The stock market is a humbling place. Have a great Independence Day and Janamashtmi.

Hello Sir, I hope this mail finds you in good health and a happy mood. I read a message in one of the social media groups where you have described in detail about your encounter with COVID recently, against the background of total chaos of the national capital. It was re-assuring to know that the entire family has recovered well and by now they must be on the path of compensating the losses in terms of health. Wishing you good health and do keep writing whenever the situation permits. Your musings are interesting to read. Regards

Dear Ajay

Thanks a lot for your concern and kind wishes. We have recovered completely from Covid and are doing fine. I am resuming my blogs now. Hope you and your families are fine.